Portfolio

Reimagine.... Reinvent.... Redesign Your Business With Zivanta Analytics

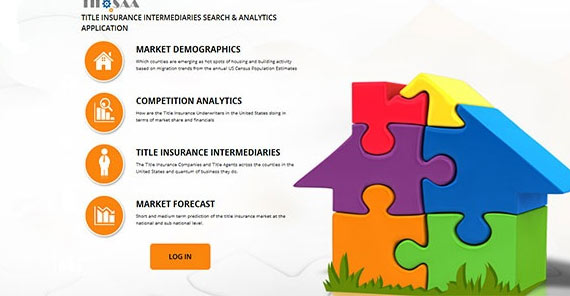

TIISAA stands for Title Insurance Intermediaries Search and Analytics Application. It is the name of the analytics consulting application that was developed by Zivanta Analytics for Servicelink, a premier provider of title insurance services in US. It aimed at assisting Servicelink to increase the market share of title insurance premiums in NY, TX, CA, PA and few other major states. Zivanta tied up with Servicelink as a strategic partner to devise a robust market entry strategy for the latter. The market entry strategy would be based on a market intelligence suite that will be designed and developed taking into account diverse economic and market forces.

Servicelink is a major subsidiary of Fidelity National Financial, one of the most prominent players in the title insurance sector and largest provider of commercial and residential mortgage diversified services in United States. Servicelink has been providing loan transaction services to the mortgage industry for more than 47 years under its parent company being Fidelity.

This was basically a market entry consulting project. The entire study was to identify where Fidelity stand in the title insurance market state-wise. The client’s objective was to get an understanding of the states to focus on as well as the ones which are dead horses. In other words Fidelity wanted to derive an idea of their position across US states in terms of competition. The study also aimed at identifying the potential markets for title insurance in relation to population and housing growth for implementing expansion plans in the emerging areas of US.

The entire project was tied up from 2 perspectives: Macro and Micro. Given below is a high level overview of the work that went into Macro and Micro analysis for Servicelink using TIISAA:

Steps Performed in Macro Analysis (overview)

Steps Performed in Micro Analysis (overview)

The final outcome, apart from the phase-wise milestones was a presentation outlining Business Strategic Options and Recommendations in each option. The options also contained the pros and cons to be taken into consideration. The option sets were data backed, validated and a robust outcome from an extensive